Methods differ not only state-to-state, but even provision-to-provision within a given state. Some use fiscal years, others calendar years, and others their own state-defined periods, while many follow the federal convention of a 12-month period running from September to August. Some states make cumulative adjustments from a base year, while others upwardly revise the figures from the prior year’s brackets.

States use different measures of inflation, different equations for their calculations, different rounding conventions, and even different dates for calculating a given year’s inflation adjustment.

#Ca tax brackets tax foundation code#

This means the tax code changes without a vote being taken, which creates a lack of political accountability. Without changes to state tax provisions, inflation increases state income tax collections significantly faster than the real growth of state income, or erodes excise tax collections as inflation reduces the value of a volume-based levy expressed in dollar terms. Without indexing, inflation can distort tax liability because inflation changes do not affect all taxpayers equally and are not in line with legislative intentions.

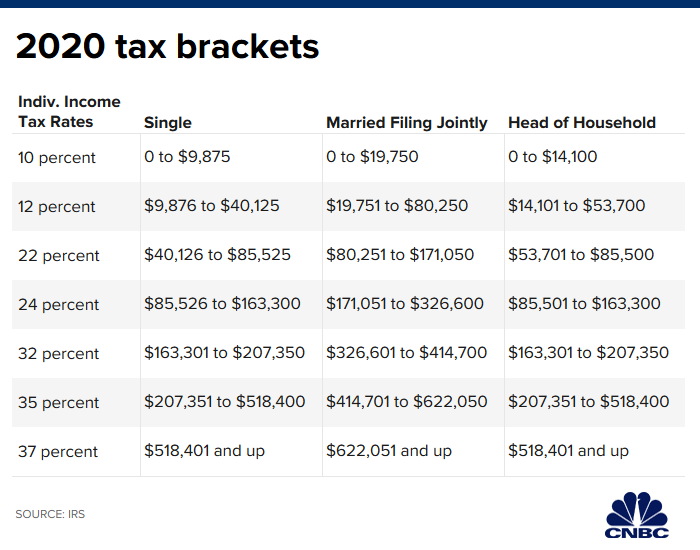

Indexing has important implications for tax equity, political accountability, and the rate of growth of government revenues. With excise taxes, indexing is generally intended to benefit the government, taking volume-based levies like a motor fuel tax and adjusting them to maintain their value in real terms. Within the individual income tax, brackets, standard deductions, personal exemptions, and other features can all be indexed to avoid the imposition of a hidden inflation tax, which occurs when a greater share of a taxpayer’s income is taxed even if their real income has not increased. Motor fuel taxes are a good example as they are typically levied in terms of cents per gallon. Absent these adjustments, income taxes are subject to “ bracket creep” and stealth increases on taxpayers, while excise taxes are vulnerable to erosion as taxes expressed in marginal dollars, rather than rates, slowly lose value.Īny tax provision tied to a specific dollar amount can potentially be inflation-adjusted. This will help you better understand how the tax brackets work, especially on a state level.Inflation indexing refers to automatic cost-of-living adjustments built into tax provisions to keep pace with inflation. That said, it’s best to think about the tax rates as cups you need to fill in first to pay the designated portion rather than something as a whole. Pay taxes gradually and make your way up to the highest rate for your taxable income, and pay taxes accordingly. You won’t pay the highest allocated portion of your income in state income taxes. Once you know the highest tax rate that applies to you, make sure to get to the highest rate gradually.

Make sure to calculate the portion of your income that’s subject to state income tax as you won’t pay all of your earnings in state income taxes.

The California state income tax return, Form 540, can guide you on figuring out the taxable income using the tax brackets. Married Filing Jointly – Qualifying Widow(er) Tax Rate California current tax tables 2023 - 2024 Single Tax rate To figure out how much a taxpayer owns in taxes, he or she needs to calculate taxable income first, then use the tax brackets for to see the tax liability. The California marginal tax rates are higher than most of the states, but not the highest.

0 kommentar(er)

0 kommentar(er)